Estimate the present value of the tax benefits from depreciation

Tax benefit 3000034 10200. Estimate the present value of the tax benefits from depreciation.

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Neither bonus depreciation nor Section 179.

. You are free to use this image on your website templates etc Please provide us with an attribution link. Depreciation per year Book value Depreciation rate. Compared to competing products.

The annual depreciation is calculated by subtracting the salvage value the estimated value of the property at the end of its useful life of the asset from the purchase price and then dividing this. Annual depreciation expense 250000 - 100008 30000. Round your answer to 2 decimal places Depr Ending Book Value - Beginning Book ValueLife of Asset 1033000 -.

APP Operating cycle - Cash cycle 120 - 75 45. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Neither bonus depreciation nor Section 179.

Simply subtract the value of the depreciation from your cash flow for each period. This reduces the tax it needs to pay by 280000. Depreciation per year as per straight line method Purchase cost Salvage value Useful life 100000 - 25000 10 75 View the full answer.

The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 153000 using straight-line depreciation. Id like a CPA.

Depreciable basis Ending book value Depreciation Life of asset 912000 142000. Present value 14205905 Present value 14205905 01 The depreciation per year will be. Estimate present value of tax depreciation claim for two types of equipment We sell a product that potentially offers a tax benefit in the US.

The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. The cost of capital is 13 percent and the firms tax. Estimate the present value of the tax benefits from depreciation.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. If company XYZ has a depreciation expense of 50000 and the tax rate is 30. Calculate annual tax savings from depreciation tax shield.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Find Average Payment Period. Estimate the present value of the tax benefits from depreciation.

The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax. Straight line depreciation 15 - 310 120 annual tax savings from depreciation 12 04 048 present value of tax savings from depreciation 048 pva 12 10 years. For example if you have a cash flow of 15000 for a period and depreciation of 1000 for the.

How To Calculate Npv With Taxes Youtube

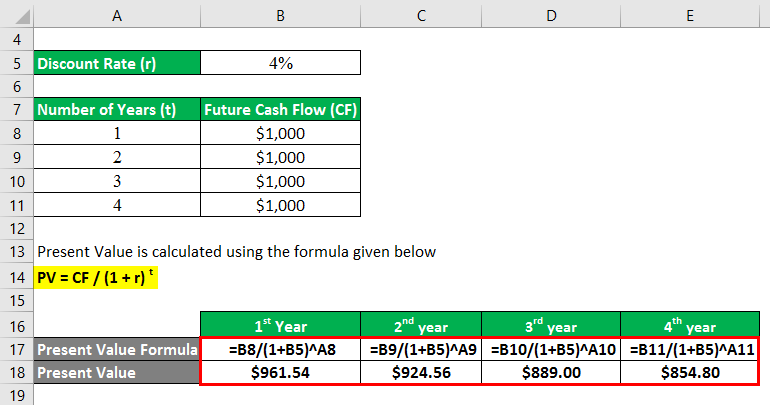

Present Value Formula Calculator Examples With Excel Template

Net Present Value Npv Financial Literacy Lessons Cash Flow Statement Accounting Education

Tax Shield Formula How To Calculate Tax Shield With Example

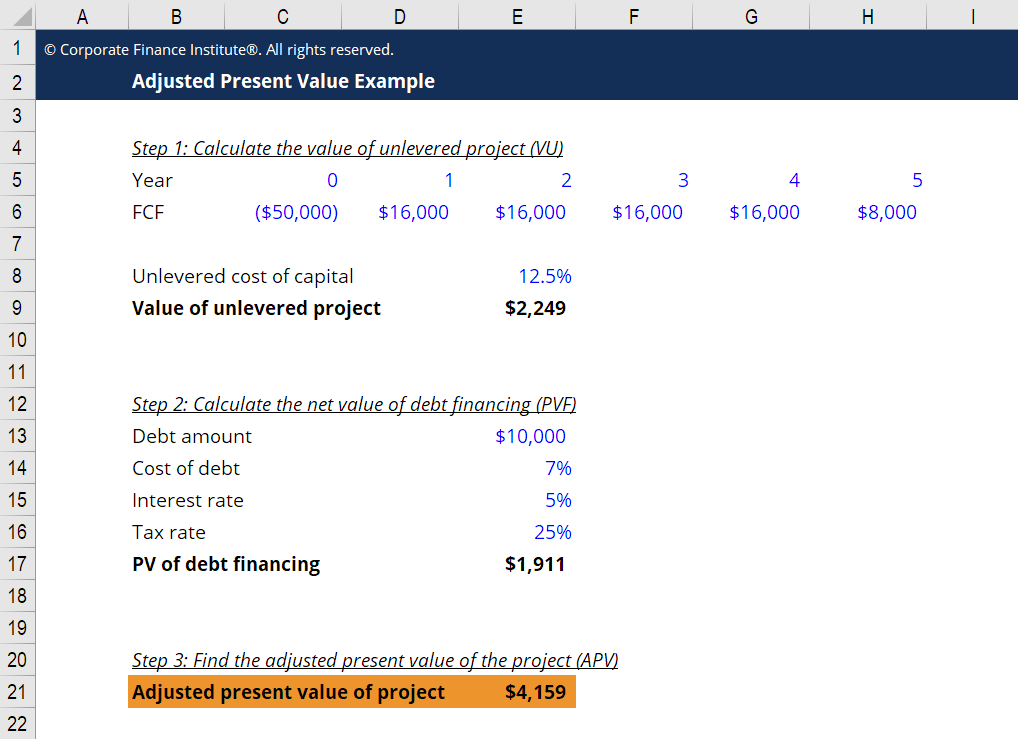

Adjusted Present Value Apv Definition Explanation Examples

Present Value Formula Calculator Examples With Excel Template

Present Value Of Depreciation Allowances Z Download Table

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

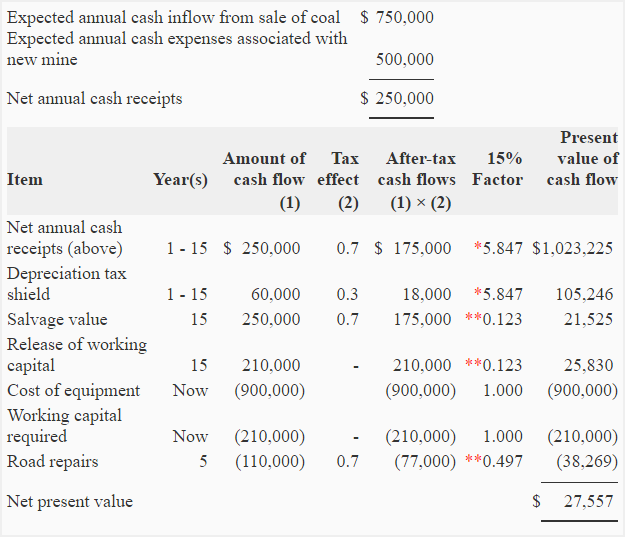

Problem 1 Net Present Value Npv Method With Income Tax Accounting For Management

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Adjusted Present Value Apv Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Npv And Taxes Double Entry Bookkeeping

Tax Shield Formula How To Calculate Tax Shield With Example